With the continuous development of new energy vehicles, energy storage, consumer electronics and other industries, especially the continuous explosion of demand for power lithium batteries, the momentum of vigorous development of the lithium battery industry continues to be promoted. The rapid development of the lithium battery industry will naturally drive increased demand in related industries, such as the lithium battery equipment manufacturing industry, which is closely related to the lithium battery industry. Today we will talk about the current situation and future of lithium battery equipment manufacturing industry.

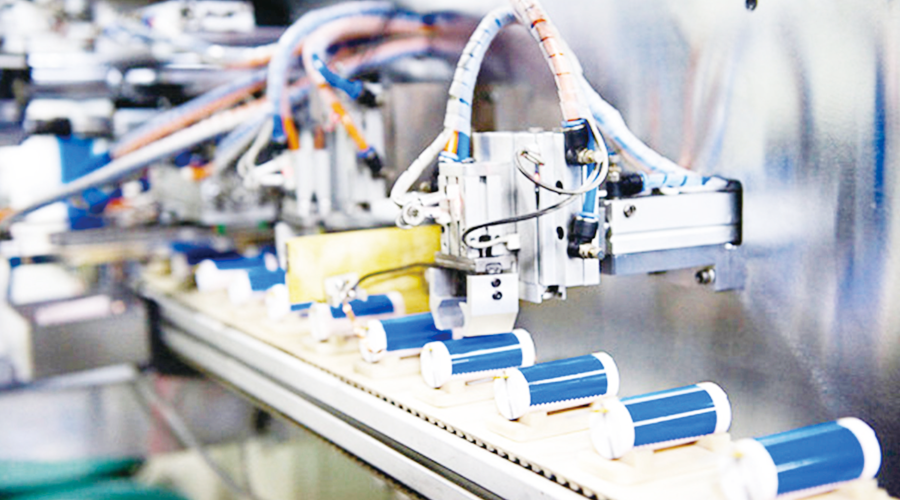

Lithium battery equipment generally refers to various manufacturing equipment used in the production process of lithium-ion batteries. Lithium battery equipment plays a decisive role in the performance and cost of lithium batteries. The production process of lithium batteries is long, with more than 20 processes in the production process, and more than 20 types of equipment are required to complete the manufacturing of each process. The equipment required for the entire process is complex and highly specific.

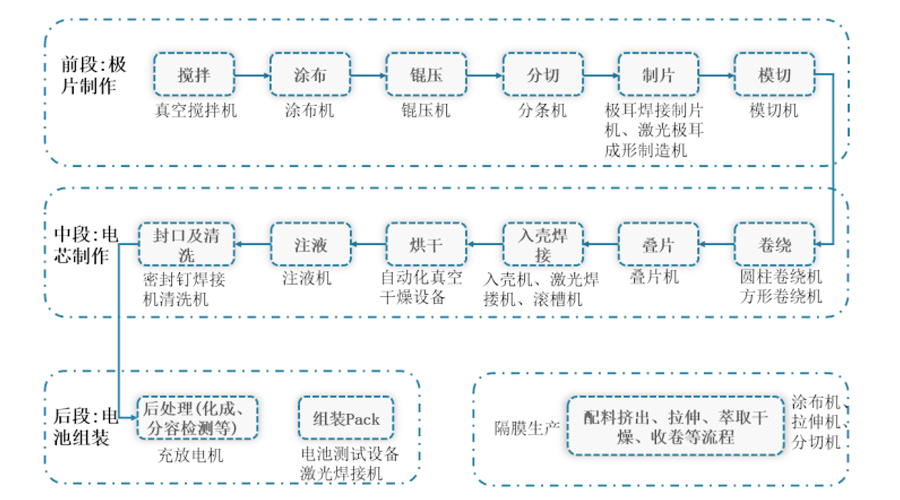

The manufacturing of lithium-ion batteries can be divided into four process stages: pole piece production, cell assembly, cell activation detection and battery packaging. The pole piece manufacturing process includes stirring, coating, rolling, slitting, tableting and other processes. It is the basis for lithium-ion battery manufacturing and has a great influence on the performance, accuracy, stability, automation level and production efficiency of pole piece manufacturing equipment. high demands;

The cell assembly process mainly includes winding or lamination, cell pre-packaging, electrolyte injection and other processes, which have high requirements for accuracy, efficiency and consistency; the cell activation detection process mainly includes cell formation, capacitance detection, etc.;

The battery packaging process includes testing, classifying, and series-parallel combination of the individual cells that make up the battery pack, as well as testing the performance and reliability of the assembled battery pack.

As lithium-ion batteries are used more and more widely, in order to meet people's usage requirements, lithium battery companies continue to expand their production scale, while lithium battery equipment companies continue to innovate technology and expand production.

Similar to the competition pattern of lithium batteries, global lithium battery equipment manufacturers are mainly Japanese and Korean companies and Chinese companies.

Most Japanese and Korean lithium battery equipment companies belong to the "small but sophisticated" type. Although Japan and South Korea's lithium battery equipment industry has lost its leading position, its strength is still considerable. The main manufacturers of lithium battery front-end equipment in Japan and South Korea include South Korea's PNT, South Korea's CIS, Japan's Asada, Japan's Hirano, etc. The main manufacturers of winding machines in the mid-end segment include Japan CKD, South Korea's KOEM, Japan's Minito, etc. South Korea's PNESolution is mainly a manufacturer of back-end lithium battery composition and composition equipment.

1. South Korea PNT

PNT is the most prestigious company in South Korea that produces coating machines, roller presses, slitting machines, and winding machines. Its important customers include well-known companies such as Samsung SDI, LG Chem, LGE, SK Innovation, and Cheil Ind. Founded in 2003, South Korea PNT Company is the most prestigious company in South Korea that produces coating machines, roller presses, slitting machines, and winding machines.

2. South Korea CIS

CIS is a Korean company established in 2002. Its main business is the production and sales of lithium-ion battery manufacturing equipment, fuel-powered lithium battery manufacturing equipment, solar cell manufacturing equipment and display manufacturing equipment. CIS Company is a master of lithium battery equipment. It produces various equipment required in various stages from pole piece production, battery unit (battery cell) production and battery assembly, and has certain technical advantages. In June 2015, Haoneng Technology and CIS jointly established Wisdom Yide and built it into an intermediary business platform for Haoneng Technology and CIS to carry out technology and market cooperation.

3. Korea Korea KOEM

Korea KOEM was established in 1987. It is mainly engaged in the research and development and manufacturing of winding machines for capacitors and lithium batteries. Its main products include lithium-ion battery winding machines, film capacitor winding machines, electrolytic capacitor winding machines, and lithium primary batteries. Winding machine, lithium primary battery assembly machine, etc.

4. Japanese plains

Nippon Hirano was founded in 1935 and is engaged in the manufacturing and sales of coating-related equipment and chemical-related equipment. Its products include optical functional film coating production lines, flexible circuit board coating production lines, battery pole piece coating equipment, non-woven fabric manufacturing equipment, etc. It is one of the important suppliers of imported coating equipment for lithium-ion batteries in my country. Benefiting from the development of the domestic lithium battery industry, the company has ample orders on hand.

5. Japanese CKD

Japan CKD Company was established in 1943. Its main products include automated machinery, pneumatic control systems, fluid control systems and labor-saving systems. After years of accumulation, Japanese CKD companies have established service outlets in Europe, North America, Central and South America, and Asia. In addition, in addition to Japan, CKD has also set up factories in China, Thailand, South Korea, Malaysia and India.

6. Asada, Japan

Japan's Asada Iron Works Co., Ltd. was founded in 1905. It has long been engaged in the research and development and production of mixing, dispersing, and crushing machinery. The company's mixing equipment includes scissor mixers and mixing and kneading machines. It is an old company that produces front-end mixing equipment for lithium battery manufacturing. After long-term accumulation, Japan's Maeda has certain competitiveness in the mixing equipment industry and has become one of the major domestic importers of lithium battery equipment.

Most domestic lithium battery companies were established or developed around 2010. With the expansion of production by domestic lithium battery manufacturers in recent years, they have developed rapidly and have completely overtaken Japan and South Korea in terms of technology and scale.

1. Leading intelligence

Pioneer Intelligence was founded in 1999 and listed on the Startup Edition in 2015. Its business covers eight major fields, including lithium battery intelligent equipment, photovoltaic intelligent equipment, 3C intelligent equipment, intelligent logistics, automobile production lines, hydrogen energy intelligent equipment, laser precision processing, and machine vision. .

Pioneer Construction has a R&D and production manufacturing base of 920,000 square meters, with more than 19,000 employees, including more than 5,500 R&D personnel. Over the years, the company’s R&D investment has accounted for

It has always maintained above 10%, and has obtained nearly 2,000 authorized patents. In the new energy equipment market, it has always maintained the first market share.

In 2021, Pioneer Intelligent's revenue will exceed 10 billion, its orders will exceed 20 billion, and its market value will be the highest at 130 billion. It has established 11 subsidiaries around the world, has more than 50 service outlets, and has employees all over the world.

16 countries and regions, and its products are exported to more than 20 countries and regions including the United States, Germany, France, Japan, South Korea, and Sweden.

2. Bozhon Seiko

Bozhon Seiko was founded in 2001 and will be listed on the Science and Technology Innovation Board in 2021. The business development in the past many years has mainly focused on the fields of automation and digital equipment dominated by the global consumer electronics giant industry chain. After long-term continuous hard work, it has formed strong technical advantages in industrial automation and digital underlying technologies. The company has also developed in the past few years. We are committed to actively applying our technological research and development advantages to more fields.

In recent years, the new energy automobile industry has experienced rapid development, and the demand for lithium battery equipment has been rapidly released. Bozhon Seiko used its many years of rich experience in the field of automation and digital equipment to enter the lithium battery equipment industry in 2017, becoming one of the earliest domestic companies to enter the lithium battery equipment industry. At present, it has a wealth of full-line equipment design, manufacturing, such as mixing and pulping equipment, coating machines, roller presses, slitting machines, die-cutting machines, laminating machines, assembly lines, chemical composition equipment, and module pack lines. After-sales service capabilities.

Among them, the thermal composite lamination all-in-one machine has a working efficiency of 1/8 second per piece, which is in the leading position in the industry and has the ability to deliver in batches;

The liquid injection machine has also achieved batch delivery capabilities, and has in-depth cooperation with Honeycomb Energy, CATL, etc., and has received hundreds of millions of orders;

We have also made great achievements in the whole package of lithium battery production lines. We have in-depth cooperation with domestic Juyuan Lithium Battery and foreign companies such as JSNE and Kontrolmatik in Turkey;

Bozhon Seiko's charging and swapping station business is also an important pillar of its lithium battery business. A total of about 600 passenger and commercial charging and swapping stations have been delivered.

In addition, Bozhon Precision also officially entered the lithium battery industry raw material equipment supplier through the acquisition of Shanghai Yuze. Its main product is the composite current collector MA vacuum coating machine.

3. Yinghe Technology

Yinghe Technology was founded in 2006 and is headquartered in Shenzhen. It was listed on the Shenzhen Stock Exchange GEM in 2015 and is committed to the research, development, production and sales of new energy intelligent equipment. At present, Yinghe Technology has developed into one of the leading companies in the industry and is one of the few companies in the world that can provide intelligent digital factory solutions for power batteries.

Yinghe Technology owns a number of wholly-owned and holding subsidiaries, as well as five major production bases located in Huizhou, Guangdong (2), Dongguan, Guangdong (2), and Yichun, Jiangxi (1), with an annual output value of up to 13 billion. It has strong technical capabilities, manufacturing capabilities and service capabilities. Its products cover the entire process section of power battery production, and it also develops personalized customized products with new processes for customers. In 2015, it was the first in the industry to propose a "power battery complete line solution" and delivered more than 40 complete lines.

In November 2019, Yinghe Technology received a strategic investment from Shanghai Electric, joining forces to build a new development pattern. In December of the same year, it signed a strategic cooperation agreement with Manz of Germany to jointly explore the global new energy market. Facing the future, Yinghe Technology will follow the upgrading and transformation trend of China's manufacturing industry, build a national-level manufacturing innovation center in the new energy field, help customers realize intelligent manufacturing, build smart factories, and make outstanding contributions to promoting Made in China 2025!

4. Lianying Laser

Founded in 2005, Lianying Laser is the country's leading supplier of laser welding equipment and intelligent manufacturing solutions. It is a listed company on the Science and Technology Innovation Board specializing in the R&D, production and sales of precision laser welding machines and laser welding complete sets of equipment. Lianying Laser mainly produces lasers, laser welding heads, laser welding machines, robot welding workstations, complete sets of laser welding automation equipment and various non-standard automation solutions.

Products are widely used in power batteries, automobile manufacturing, consumer electronics, hardware and home appliances, optical communications, medical equipment, plastic welding and soldering and other fields. At present, a total of more than 600 sets of non-standard customized automated laser welding systems have been delivered, meeting the welding requirements of more than 1,300 products. It is the largest domestic enterprise focusing on the research and development of laser welding in the new energy industry. Cooperating customers include CATL, Guoxuan Hi-Tech, BYD, Gree Intelligence, Foxconn, Tyco Electronics, Changying Precision, Yiwei Lithium Energy, Panasonic, Samsung, AVIC Power and other well-known enterprises in the industry.

5. Hangke Technology

Hangke Technology is located in Hangzhou City. It was founded in 1984 and was successfully listed on the Science and Technology Innovation Board in 2019. With more than 30 years of professionalism, focus and continuous innovation, Hangke Technology has built a global business and service network to provide customers with overall solutions for lithium battery post-processing systems.

Its cooperative customers include Samsung SDI, LG Chem, SKI, Sony (now Murata), Panasonic, Toyota, Kyocera, TDK, CATL, BYD, ATL, Yiwei Lithium Energy, AVIC Lithium Battery, Guoxuan Hi-Tech, Funeng, and Crown. Yu, Jiewei, Weihong Power, Lishen, Wanxiang A123, BAK, Sunwanda and other companies.

In the future, Hangke Technology's goal is to build the first brand in the lithium battery smart equipment industry and become "the world's first-class overall solution provider for lithium battery smart factories."

6. Han's Laser

Han's Laser was founded in Shenzhen, China in 1996. It is the world's leading industrial laser processing and automation overall solution service provider. It was listed on the Shenzhen Stock Exchange in 2004.

Han's Laser officially established the new energy business group in April 2021. By integrating talents, technology and market resources, it will exert greater efficiency, coordinate development, strive for excellence, and strive to make products more refined and superior. Products cover: homogenization, stirring, coating, rolling, die-cutting, slitting, winding/lamination, battery assembly, baking, liquid injection, composition and volume, blue film, module assembly and PACK assembly and other series of new energy equipment, and equipped with the advanced MES production management system independently developed by Han's, improving the digitalization, informatization, and networked series connection of the front, middle, and back-end equipment of battery manufacturing.

Product application scope includes: new energy power battery manufacturing industry, energy storage and solar photovoltaic industry, 3C digital battery industry, etc.

7. Li Yuanheng

Li Yuanheng was founded in 2014 and listed on the Shanghai Stock Exchange's Science and Technology Innovation Board in 2021. It is a leading lithium battery equipment company in the world's first echelon and one of the advanced companies in the field of digital intelligent chemical plants. It is mainly engaged in the research and development of intelligent equipment. , production and sales, providing digital intelligent whole-plant solutions for leading companies in the new energy (lithium battery, photovoltaic, hydrogen energy) industry!

Li Yuanheng has achieved full chain coverage from intelligent process equipment, automated production lines, intelligent warehousing and logistics, information products to digital factories. Its main customers include ATL, CATL, BYD, Guoxuan Hi-Tech, Sunwanda, Honeycomb Energy, and Micro Macro , Vision, Volkswagen, Samsung and other Fortune 500 companies and leading companies in various fields. The intelligent equipment developed and manufactured by Li Yuanheng has passed certifications of various European and American standards such as CE and NRTL. As of December 30, 2022, it has more than 3,001 intellectual property rights at home and abroad, and has participated in the establishment of more than ten national standards, industry standards and group standards.

In conclusion, Chinese lithium battery equipment companies have surpassed Japanese and Korean companies in terms of equipment technology, business scale, and service capabilities. Domestic lithium battery equipment has already occupied a dominant position not only in newly built lithium battery factories in China. For example, CATL, the world's largest power lithium battery company, has more than 86% of domestically produced equipment in its new production lines. Moreover, domestic lithium battery equipment has begun to counterattack, entering the production lines of Japanese and Korean lithium battery manufacturers. In the battery production lines of Panasonic, Samsung, and Sony, the proportion of Chinese production equipment is also increasing.

Most Japanese lithium battery equipment companies were established in the 1940s to 1960s, and grew with the rise of the Japanese lithium battery industry in the 1980s and 1990s. Most Korean lithium battery equipment companies were established around 2003, with the rise of LG Chem, Samsung SDI and other Korean companies. The company grew up after developing lithium batteries around 2000. Since the lithium battery equipment companies in these two countries have been established for a long time and have enough development time, they are still in a leading position at the technical level. However, currently, Japanese and Korean lithium battery equipment manufacturers generally have a single product range, a small number of employees, a slow expansion of production capacity, and a gradual loss of competitive advantages.

In contrast, the competitive advantages of Chinese lithium battery equipment companies are already very clear. This is due to the fact that Chinese lithium battery companies have occupied a dominant position in the global lithium battery industry, and China has been the largest lithium battery consumer market for five consecutive years. As the penetration rate of new energy vehicles continues to rise, the production expansion of leading battery companies has accelerated, coupled with the rapid development of the energy storage field, supporting the continued growth of demand for lithium battery equipment. Data shows that China's lithium battery equipment market size will be 58.8 billion yuan in 2021, and the average annual compound growth rate of the market size from 2017 to 2021 is 27.4%. It is expected that China's lithium battery equipment market size will reach 107.7 billion yuan in 2023. The continuous expansion of the market scale continues to stimulate the R&D investment and scale expansion desire of lithium battery equipment companies.

At present, the overall localization rate of lithium battery equipment reaches more than 90%. The front-end equipment is slightly lower than the middle and back-end equipment. Some high-end models of the coating machine, the core equipment of the front-end equipment, still need to rely on imports. The middle and back-end processes are relatively simple. Therefore, import substitution has been basically completed, and the competitiveness has been greatly improved, especially in the aspect of complete line general contracting.

The main reason is that in the past, lithium battery production capacity has not completely exploded. Lithium battery companies have strong requirements for equipment certainty and control. They will basically choose to purchase equipment in segments. The demand for the entire line is not strong. Japanese and Korean companies focus on certain areas. Mature technology has obvious advantages.

However, since 2020, due to the explosion in demand for lithium batteries, the production capacity of lithium battery companies has been seriously insufficient, and the industry's demand for production expansion has increased, attracting many new players without technology accumulation to enter the lithium battery industry. The demands of these entering companies for equipment are that the production lines can be put into production quickly, so the whole-line turnkey form will become their choice. In terms of complete line general contracting, Chinese lithium battery equipment companies benefit from the high degree of equipment technology completion, short delivery time, low cost and talent advantages. Compared with Japanese and Korean companies that are small and sophisticated and have high talent costs, they have the advantage Considerable competitive advantage.

In the past, equipment with a high degree of customization could only be produced and supplied in small batches, unable to achieve economies of scale, and the cost remained high. Since subsidies began to decline year by year, power battery companies have never stopped demanding price reductions from lithium battery equipment manufacturers. Especially as the market concentration becomes higher and higher, power battery companies are squeezing the price space of equipment companies even more fiercely. .

Nowadays, due to the shortened delivery cycle of lithium battery equipment companies, insufficient preparations for early equipment debugging have led to the need for after-sales care work. In addition, improper equipment operation in the later stage of battery companies has caused after-sales maintenance, resulting in after-sales service costs becoming higher and higher, encroaching on the company's More and more labor costs and profit costs.

As client production expansion accelerates, large-scale repetitive orders will appear, which will help lithium battery equipment manufacturers improve product standardization and create economies of scale, thereby reducing expense rates and increasing net profit margins.

Lithium battery equipment is mostly non-standard equipment customized for customers and is closely related to the needs of downstream customers. However, some special machines are highly standardized. Most of the modules of the equipment are universal at the bottom, and some are optional or customized for customers. demand, realize the "standardization" of "non-standard equipment" and realize modular flexible production. As the standardization of equipment continues to increase, lithium battery equipment manufacturers already have the ability to mass produce and supply some equipment. For example, in March 2022, Pioneer Intelligent announced the winning bid for 200+ stacking machine orders (including all-in-one cutting and laminating machines and thermal laminating machines). sheet machine) and 100+ sets of new-generation roller slitting all-in-one machine orders. In addition, Bozhon Seiko's liquid injection machine, laser die-cutting machine, cutting and stacking integrated machine mentioned above, as well as Hangke Technology's composition and volumetric machine, Li Yuanheng's laminating machine, etc., all have a relatively high degree of standardization.

This all shows that lithium battery equipment companies improve the standardization of equipment, have the ability to supply large quantities to create economies of scale, reduce R&D production costs and after-sales service costs, and increase profit margins are the general directions for the future development of lithium battery equipment.

As excellent domestic battery manufacturers such as CATL, BYD, China New Aviation, Everview Lithium Energy, Sunwanda, Funeng Technology, Honeycomb Energy, and Guoxuan High-tech increase their efforts to explore overseas markets, more and more domestic lithium battery equipment Manufacturers have also gradually entered the supply chain of international car companies by supplying overseas bases of leading lithium battery manufacturers, and the globalization process of domestic lithium battery equipment has gradually accelerated.

Affected by factors such as the rapid growth of global lithium battery demand, Europe's continued efforts to increase local power battery production capacity, the further increase in the speed of new production lines established by large foreign lithium battery manufacturers such as Panasonic and LG Chem, as well as new European lithium battery entrants, the international competition for lithium battery equipment has Further intensifying, Chinese lithium battery equipment has become an important player in international competition by virtue of its advantages such as high cost performance and rapid expansion of production capacity, and has successively received orders from foreign lithium battery manufacturers.

In 2022, companies such as Pioneer Intelligent, Yinghe Technology, Li Yuanheng, and Bozhon Seiko will all obtain a lot of lithium battery equipment-related business overseas.

From the full text, the global lithium battery equipment industry is also developing along the development trajectory of lithium batteries. China's lithium battery equipment industry is on the rise. Lithium battery equipment companies such as Pioneer Intelligence, Yinghe Technology, Lianying Laser, Hangke Technology, Han's Laser, Li Yuanheng, and Bozhon Seiko have participated in the global competition. In terms of technology, the entire line Comprehensive catch-up has been achieved in terms of packaging and industrial scale. With the continuous improvement of the standardization of lithium battery equipment, the trend of Chinese lithium battery equipment taking a dominant position in global competition has become very obvious.

Although our country currently has great advantages in lithium battery equipment, we must always be prepared for danger in times of peace. For example, several university research institutions in the EU have formed a research project called the "EU Magnesium Interactive Battery Community". This project has received EU funding support and aims to develop an energy density of more than 1,000 watt-hours per liter, which is equivalent to twice that of lithium batteries;

The University of Houston in the United States developed a high-energy magnesium battery in 2020, which can be used in battery storage for electric vehicles and renewable energy systems;

Japan is studying batteries using manganese oxide as the positive electrode and magnesium metal as the negative electrode. In addition, Japan has also studied zinc batteries, which greatly reduces the risk of battery fires.

Domestic companies such as CATL are investing in the field of sodium batteries. They have previously released a sodium battery, which has the highest energy density and ultra-fast charging characteristics in the world so far. It can charge 80% in 15 minutes. In the future, CATL will continue to improve the energy of sodium batteries. Density may form a basic industrial chain by 2030.

Once these research results are truly commercialized, in order to meet the needs of new products and develop equipment that meets the requirements, it will inevitably have an impact on the product systems of existing lithium battery equipment companies. In the future, the R&D capabilities and strategic layout capabilities of lithium battery equipment companies will also be increasingly impacted and tested.